The Two Principal Sources of Financing for Corporations Are

Sources Of Financing Business. C common equity and preferred equity.

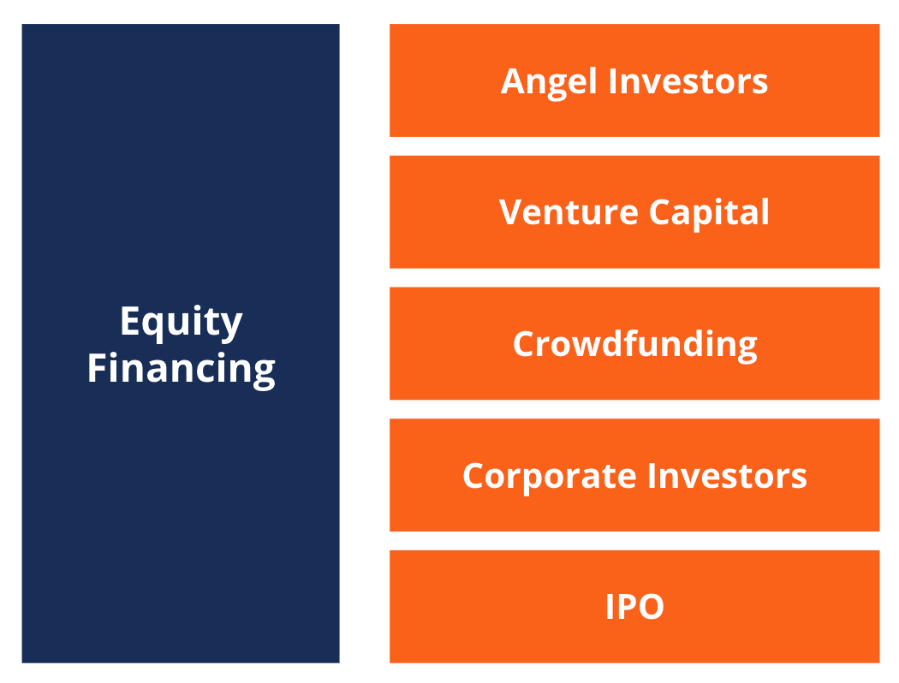

Equity Financing Overview Sources Pros And Cons

A cash and common equity.

. 5 Ratings 11 Votes Two principal sources of financing for corporations are. The two principal sources of financing for corporations are. This is the most basic source of funds for any company and.

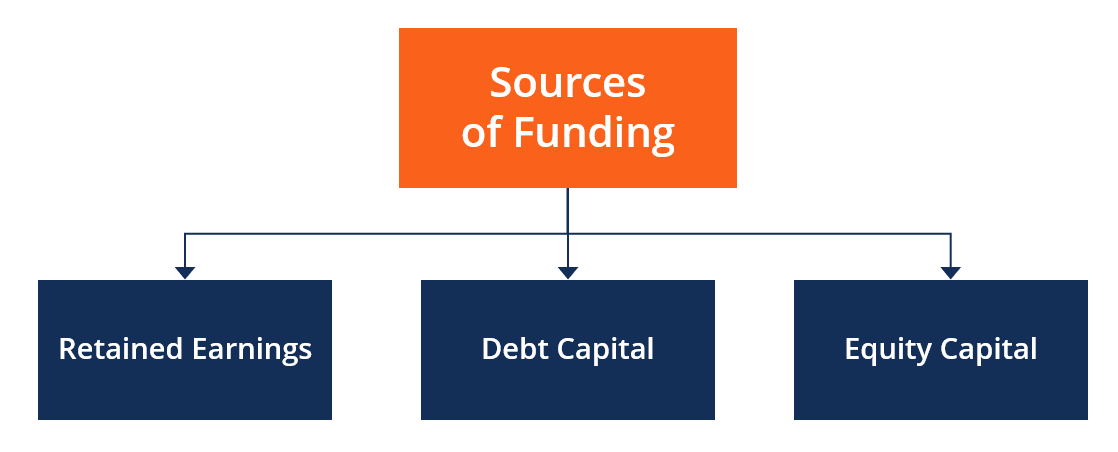

What Are the Two Main Sources of Finance for Businesses. These are the two principal sources of financing. Debt and accounts payable b.

The two principal sources of financing for corporations are. B debt and equity. In search of ideas to increase sales and gain market share a companys leadership reaches out to potential.

B debt and equity. This assumes of course that you can generate enough cash flow to cover the interest payments which are tax deductible and return the principal. External financing may be needed if sources of internal financinglike personal funds the business owner can use or funds from family and friendsare not available.

Two principal sources of financing for corporations area. Companies generally exist to earn a profit by selling a product or service for more than it costs to produce. Common equity and preferred equityd.

Common equity and preferred equity d. One of the two main sources of stockholders equity is paid-in capital. Two of the main types of finance available are.

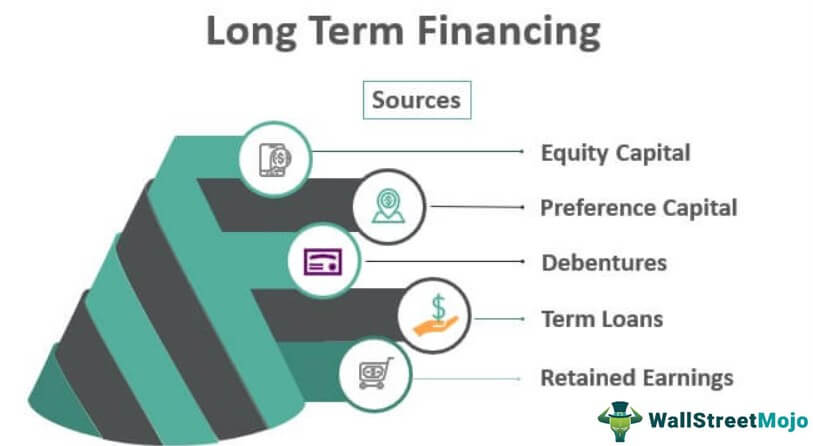

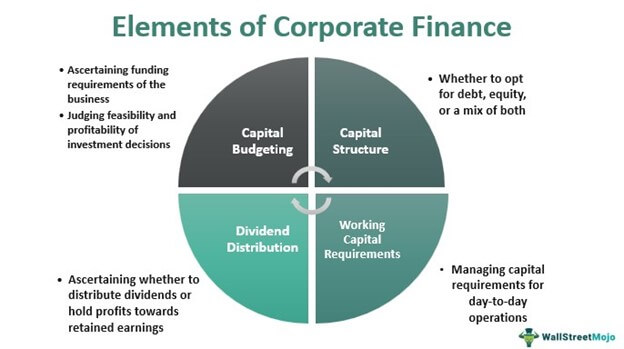

SATYAVANI B answered on February 04 2021. This review evaluates the four major theories of corporate financing. 2 the trade-off theory in which firms balance the tax advantages of borrowing against the costs of financial distress.

The more industrious among them include International Finance Corporation IFC EXIM Bank and Asian Development Bank. Common equity and preferred equity. Commercial Bank Loans and Overdraft.

Banks are like the supermarket of debt financing. D cash and common equity. To finance growth any ongoing business must have a source of funds.

The broad classification is debt and equity. Answered Jun 2 2016 by. These bodies are set up by the Governments of developed countries of the world at national regional and international levels for funding various projects.

171 General Sources of Corporate Funds Sources. The difference between debt and equity finance. 3 agency theories in which financing.

A significant source of new funds that corporations spend on capital projects is earnings. A venture capital firm is a limited liability partnership specializing in raising money to invest in the private equity of young firms. Debt and accounts payable b.

The two primary sources of external financing for business operations are taking on debt to sustain operations or selling shares of your company to investors. B debt and equity. The two principal sources of financing for corporations are A debt and accounts payable.

The two principal sources of financing for corporations are debt and accounts payable. Apart from bank and trade debt the. Best Common Sources of Financing Your Business or Startup are.

Paid-in capital is the money brought into the business by selling stock in the company. Common equity and preferred equity d. The two principal sources of financing for corporations are A cash and common equity.

Cash and common equityc. D debt and accounts payable. Asked Jun 2 2016 in Business by RedHotChilePicante.

Equity finance money sourced from within your business. Debt and accounts payableb. See full answer below.

One important benefit of raising equity may be that it acts as a feedback loop for corporate management. Personal Investment or Personal Savings. D debt and accounts payable.

These funds are often the initial. Cash and common equity. The two principal sources of financing for corporations are.

Cash and common equity c. They provide short- mid- or long-term financing and they finance all asset needs including working capital equipment and real estate. 1 the Modigliani-Miller theory of capital-structure irrelevance in which firm values and real investment decisions are unaffected by financing.

Financial Management 37 The two principal sources of financing for corporations are. Debt finance money provided by an external lender such as a bank building society or credit union. C common equity and preferred equity.

B debt and equity. C common equity and preferred equity. See full answer below.

On the other hand Intel General Electric and Sun Microsystems act as corporate ventures by providing equity capital to new innovative companies.

:max_bytes(150000):strip_icc()/dotdash_final_Optimal_Use_of_Financial_Leverage_in_a_Corporate_Capital_Structure_Dec_2020-02-53842f4fc058478b8b874decd8e1c8af.jpg)

Use Of Financial Leverage In Corporate Capital Structure

Camscanner Understanding Scanner App Greater Than

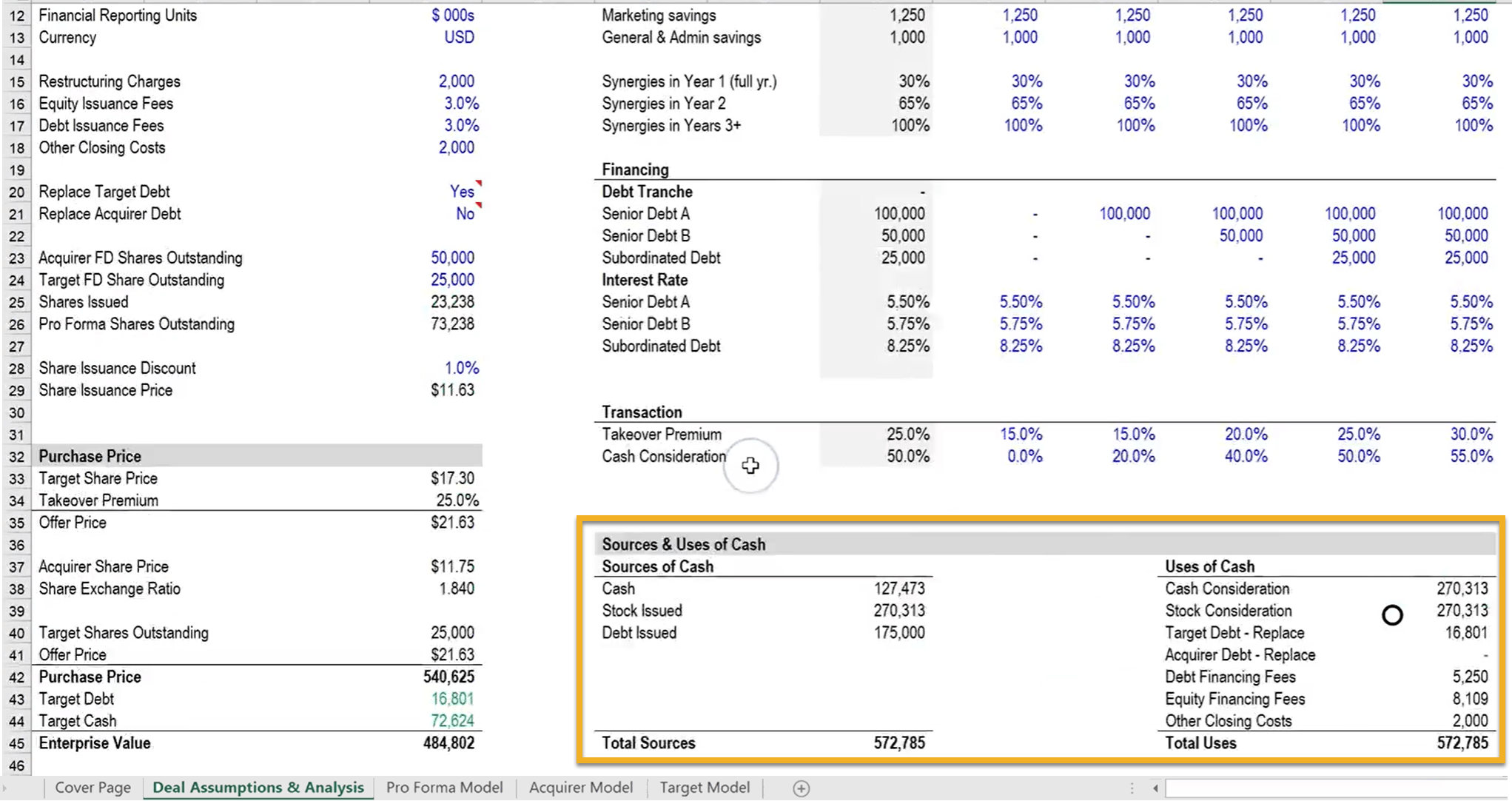

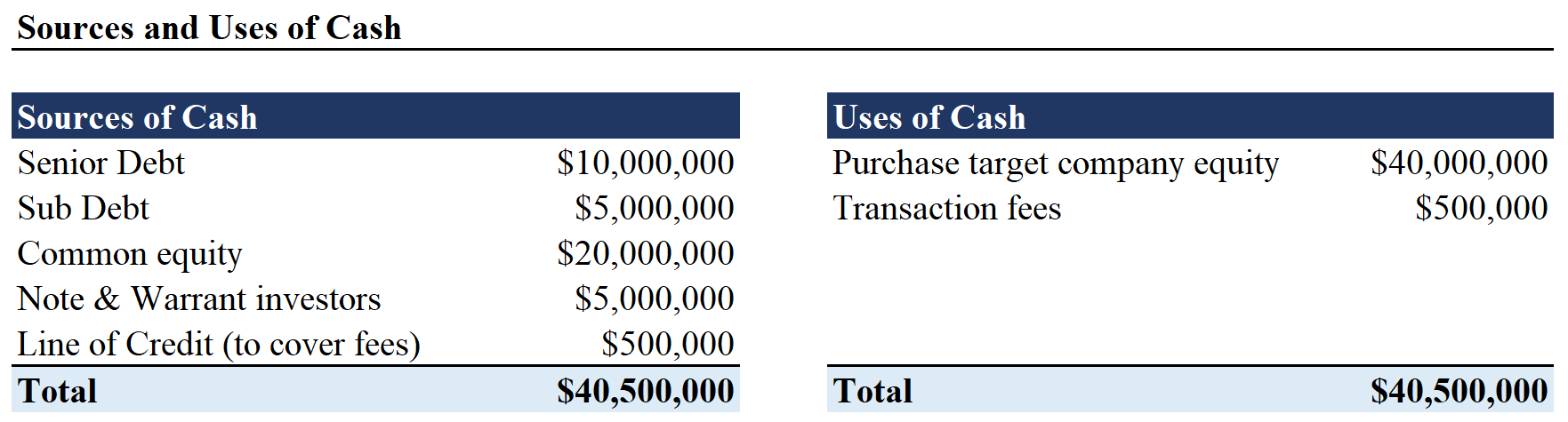

Sources And Uses Of Cash How To Build A Sources Uses Table

Sources And Uses Of Cash How To Build A Sources Uses Table

Sources Of Funding Overview Types And Examples

Long Term Financing Definition Top 5 Sources Of Long Term Financing

What Sources Of Funding Are Available For Companies

Corporate Finance Definition Principles Examples Types

Business Financing Sources Of Finance

What Is Verbal Communication Advantages And Disadvantages Of Verbal Communication A Plus Topper What Is Verbal Communication Communication Intrapersonal

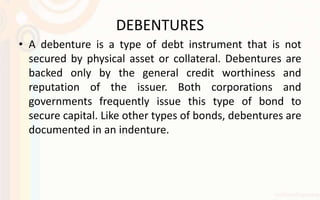

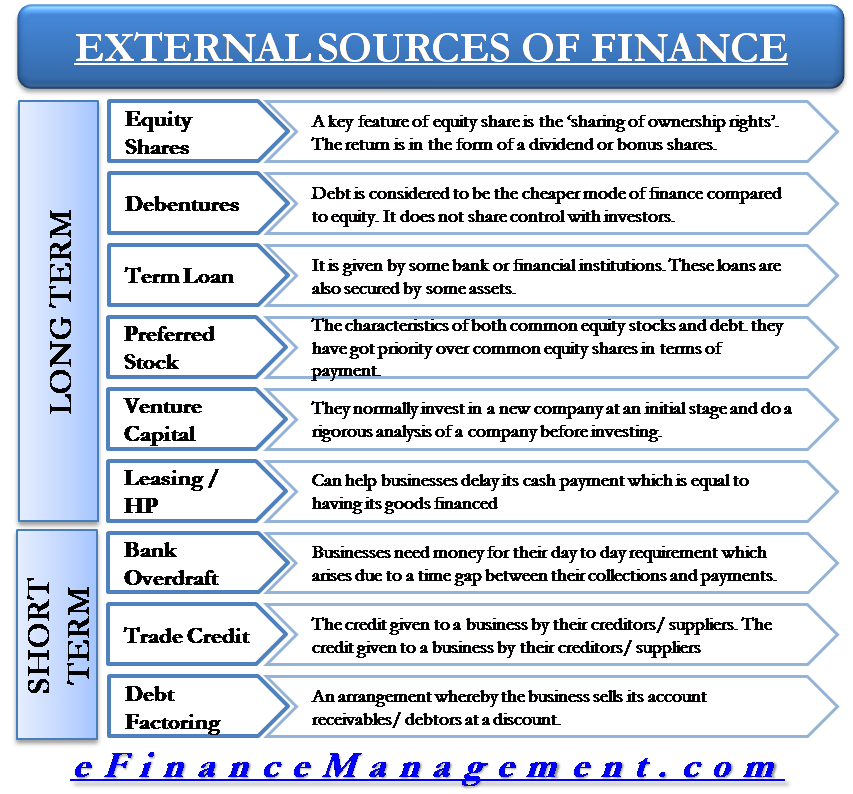

External Sources Of Finance Capital

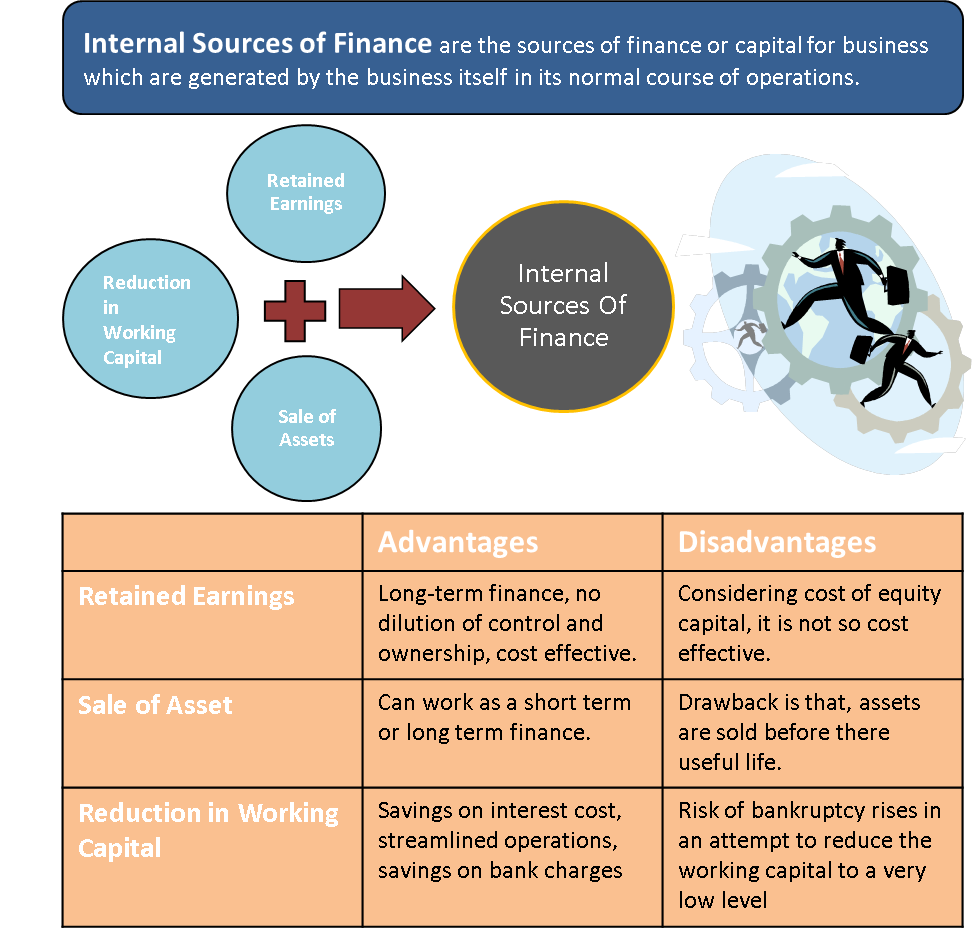

Internal Sources Of Finance Retained Profits Sale Assets Wc Reduction

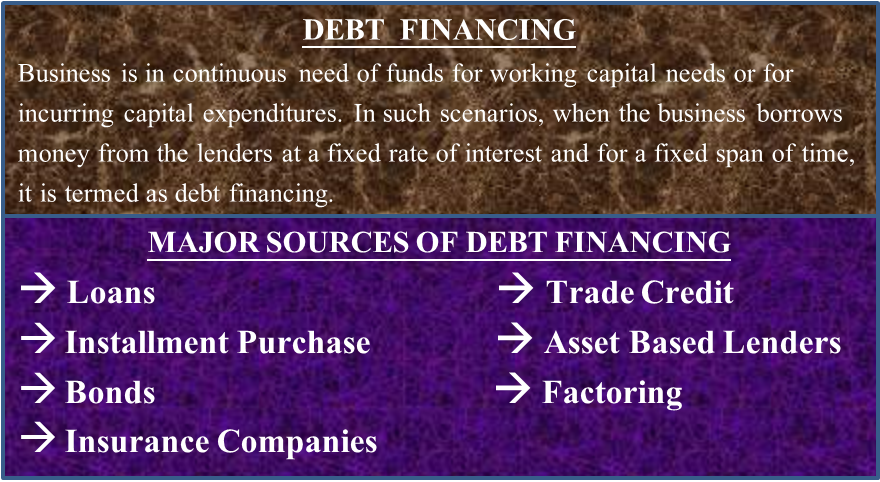

Sources Of Debt Financing Type Loan Trade Credit Factoring Bond Etc

/dotdash_final_Optimal_Use_of_Financial_Leverage_in_a_Corporate_Capital_Structure_Dec_2020-01-33c6c3ed09c343f6a6693266ee856c8e.jpg)

Comments

Post a Comment